In recent years, the consumer web has witnessed a fascinating paradox. Small teams of developers have created products that reach tens or hundreds of millions of users, yet few of these users own equity in the companies they contribute to before a large liquidity event like an IPO. Loyal3 is aiming to change this by providing consumers with the ability to easily buy stock from companies they love directly from their websites or Facebook pages.

A Seamless Experience for Stock Ownership

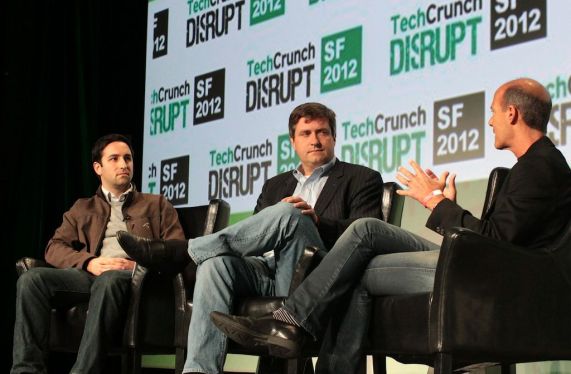

Loyal3’s CEO, Barry Schneider, emphasized that his platform offers a seamless experience for stock ownership. With just three clicks and as little as $10, users can invest in their favorite companies without incurring typical brokerage fees. This ease of access to equity ownership may have a significant impact on the way companies raise capital.

The Importance of Stock Ownership

According to Schneider, stock ownership is a relatively limited phenomenon in the U.S., with only 18% of Americans investing in companies. By making it easier for consumers to own shares in their favorite companies, Loyal3 may help increase access to capital for more companies.

"That’s going to create a lot of new capital formation," said Schneider. He added that having a platform like Loyal3 will make it easier for companies to go public, especially those with smaller market capitalization. "You’re an orphan company if you’re not doing a $100 million IPO or more," he noted.

How Loyal3 Works

Loyal3 partners with publicly-traded companies to create Customer Stock Ownership Plans (CSOPs). In a CSOP, the company pays the brokerage fees on behalf of the investor. This allows the company to have a closer relationship with its shareholders and potentially increase loyalty among customers.

A New Era for IPOs

Loyal3 has also introduced the concept of an IPO CSOP, which enables customers to invest in a company’s IPO on the same terms as the underwriters’ wealth management clients. This is particularly beneficial for retail investors who often face significant hurdles when trying to participate in highly hyped IPOs.

The JOBS Act and Its Implications

Schneider acknowledged that the passage of the JOBS Act has raised concerns about investor protections. The act has stripped away many regulations, including Sarbanes-Oxley requirements on accounting and historical financial data in initial IPO filings. Schneider emphasized the need for a balance between access to capital and investor protections.

"We need to have a balance," said Schneider. "If investor protections go back up, access to capital goes back down. But we should be able to do both." He expressed concerns that if investor protections are not reinstated, it may limit the potential of platforms like Loyal3 to increase access to capital for more companies.

Risks Associated with Investing

Moderator Eric Eldon asked about the risks associated with investing on the Loyal3 platform. Schneider emphasized that the same risks apply as when investing in non-CSOP, publicly-traded companies. He noted that users should exercise caution and follow traditional investing advice, such as Caveat Emptor.

Conclusion

Loyal3’s innovative approach to stock ownership has the potential to revolutionize the way consumers invest in their favorite companies. By making equity ownership more accessible and easier to navigate, Loyal3 may help increase access to capital for more companies, especially those with smaller market capitalization. However, it is essential to strike a balance between access to capital and investor protections to ensure that investors are safeguarded while also allowing platforms like Loyal3 to reach their full potential.

Related Articles

- Meta execs obsessed over beating OpenAI’s GPT-4 internally, court filings reveal: Meta executives were preoccupied with surpassing OpenAI’s GPT-4, a recent court filing has disclosed.

- Flights delayed by SpaceX’s falling rocket debris: Flights have been affected by the fall of a SpaceX rocket in recent days.

- A comprehensive list of 2024 and 2025 tech layoffs: A list of significant tech layoffs from 2024 and 2025 is available.